In today’s business world, which is filled with uncertainty, risks, and rapid changes, being prepared to handle disruptions and unforeseen crises is absolutely essential. One of the key tools that enables organizations to plan, respond, and continue operating effectively during a crisis is Risk Assessment. This article will explore the principles, steps, and importance of risk assessment in the context of business continuity.

What is Risk Assessment ?

Risk Assessment (RA) is the overall process of Risk Identification, Risk Analysis, and Risk Evaluation, as defined by ISO 31000:2018 on Risk Management. This international standard outlines the principles and guidelines for managing risk effectively within organizations.

Risk assessment is considered one of the key components of a Business Continuity Management System (BCMS). It is often conducted alongside a Business Impact Analysis (BIA), with the goal of identifying and reducing risks that could potentially disrupt the organization’s critical activities.

to gain a more understanding of risk management and to be better prepared for unexpected events,

You can read more about what BIA is, or what is BCP? and what is BCMS?

Risk Assessment in 3 Steps What are they?

Risk assessment should be conducted systematically, iteratively, and collaboratively with a stakeholder participation. This approach helps gather in-depth information and diverse perspectives for analysis, and supports informed decision-making when selecting risk mitigation strategies. According to ISO 31000, the risk assessment process consists of three main steps:

1. Risk Identification

The objective is to identify and understand risks that may affect the achievement of the organization’s objectives both positively and negatively. This step requires the use of relevant and up-to-date information to accurately identify risks.

2. Risk Analysis

Risk Analysis is the step in which the nature and characteristics of risks are examined, including the level of risk. This involves considering details such as the likelihood of occurrence, severity, complexity of the risk, and the existing control measures. The goal is to assess the level of risk and its potential impact, as well as to gain a deeper understanding before moving on to the next step which is Risk Evaluation.

3. Risk Evaluation

This is a decision-support process that involves comparing the results of the risk analysis with the organization’s acceptable risk criteria. The purpose is to determine appropriate strategies for managing each risk based on its assessed level.

What techniques are available for identifying risks?

There are many techniques available for risk identification, and choosing the right technique depends on the type of business, the nature of the risks involved, and the topics the organization prioritizes. This section explores examples of risk identification techniques based on different types of businesses, as follows:

Typically, the focus is on safety and hazards associated with production processes, with examples including:

HAZOP (Hazard and Operability Study)

FMEA (Failure Modes and Effects Analysis)

FTA (Fault Tree Analysis)

The focus is on risks related to capital markets, credit, liquidity, and operations. Examples of risk identification and analysis techniques include:

Monte Carlo Simulation,

Value at Risk (VaR), or

Scenario Analysis

For this sector, the focus is on information security, data protection, system availability, and cyber threats. Here are some commonly used risk identification techniques:

Threat Modelling, Attack Trees, and

Vulnerability Assessment

The focus is on project management, cost control, and safety. Examples of risk identification techniques include:

Risk Breakdown Structure (RBS),

SWOT Analysis, and

Historical Data Review

Techniques used in Risk Analysis

Risk Assessment Methods are generally divided into two main types:

1. Qualitative Risk Assessment

2. Quantitative Risk Assessment

Each method has its own strengths and is suitable for different contexts, as outlined below:

- Quantitative Risk Assessment is an in-depth analysis method that relies on numerical data and statistics. The results are typically expressed in quantifiable terms, such as the monetary value of potential losses or the probability of occurrence. This approach provides a clearer picture of the potential impact and supports data-driven decision-making.

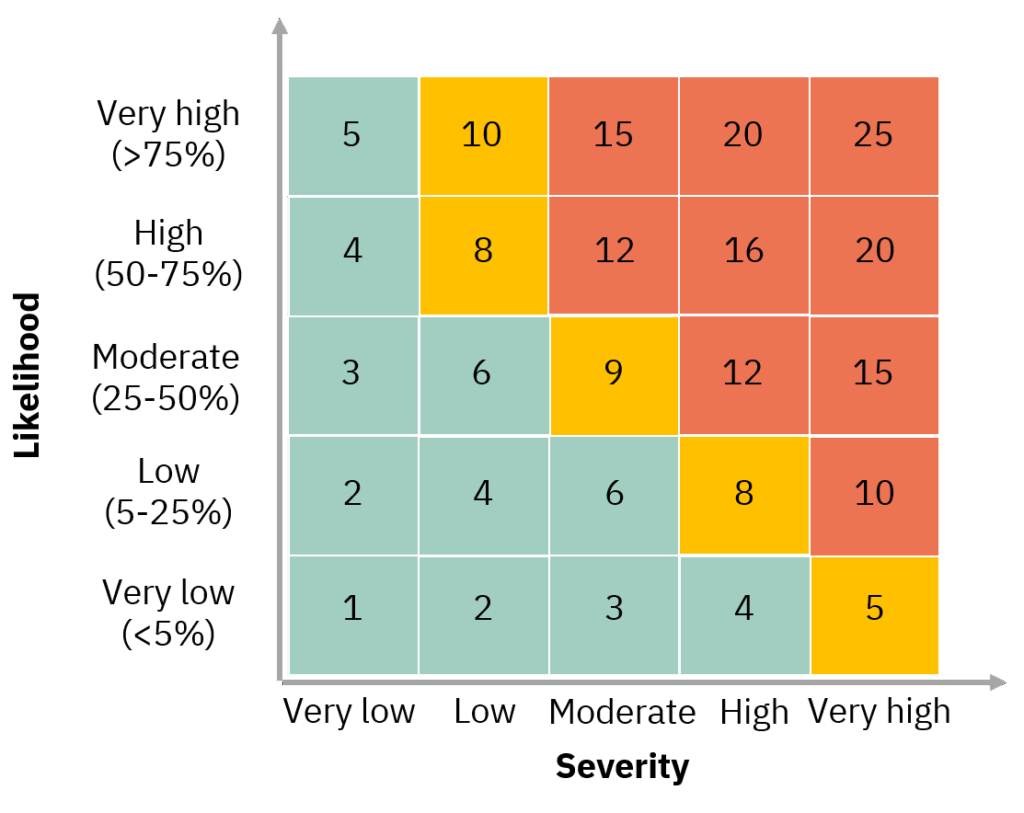

- Qualitative Risk Assessment is suitable for preliminary risk evaluations that are not highly complex or when data is insufficient. The results of qualitative analysis are often presented using a Risk Matrix, which assesses risk based on:

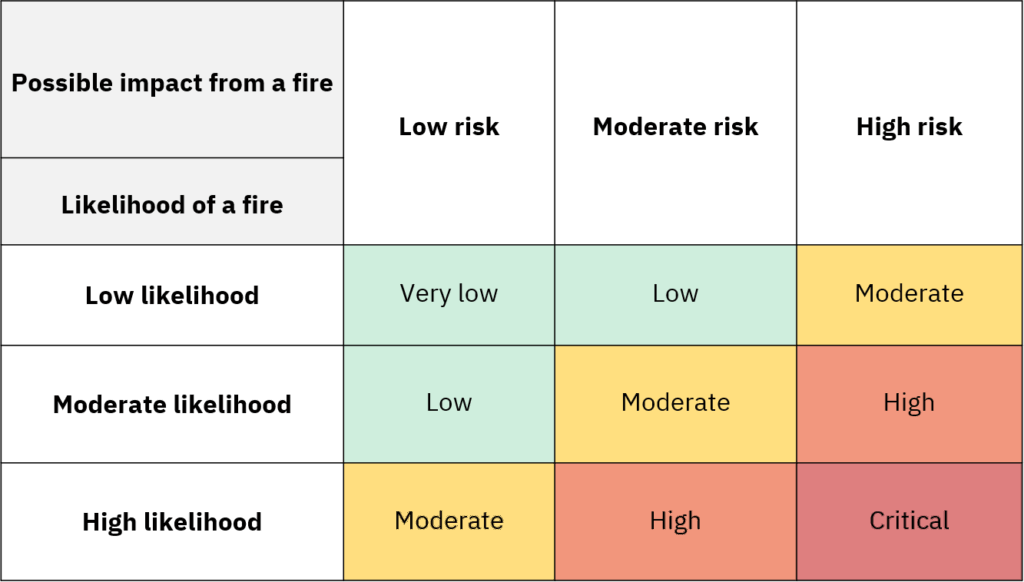

Example of Risk Assessment

Here is a sample Risk Matrix used to assess fire risk in a residential building, based on the combination of likelihood and severity:

Definitions for Likelihood and Impact can be specified as follows:

- Low risk – no serious injuries or fatalities to the residents at all.

- Moderate risk – there may be serious injuries to some individuals and fewer than two fatalities.

- High risk – there are serious injuries and more than two fatalities among the residents.

- Low likelihood – the area has a low risk of fire and effective risk management.

- Moderate likelihood – the area has a moderately high fire risk but effective risk management.

- High likelihood – the area has a high risk of fire but insufficient risk management.

If you’re interested in a more detailed risk assessment, you can read our blog about earthquake risk assessment, which explains the seismic risks in Thailand and outlines response strategies to reduce the risk of business disruption.

Free Download! Risk Assessment Form from InterRisk

To help your organization manage risks effectively, we offer a free downloadable Risk Assessment Template designed by our team of professionals!

- Easy to use

- Covers main key aspects

- Instantly applicable

Get comprehensive risk assessment with InterRisk Asia

In a time when businesses face unexpected threats and increasingly complex risks, we are here to help you analyze, prevent, and plan for risks in a systematic way. Contact InterRisk’s advisory team today to reduce your exposure to risk.

InterRisk Asia is a leading business continuity consulting firm in Thailand, operates under the MS&AD Group from Japan.

Experienced consultants with hands-on BCMS expertise

Customized planning tailored to your business context.

Practical tools and templates, with expert support for testing and improvement.